LinkedIn post 1

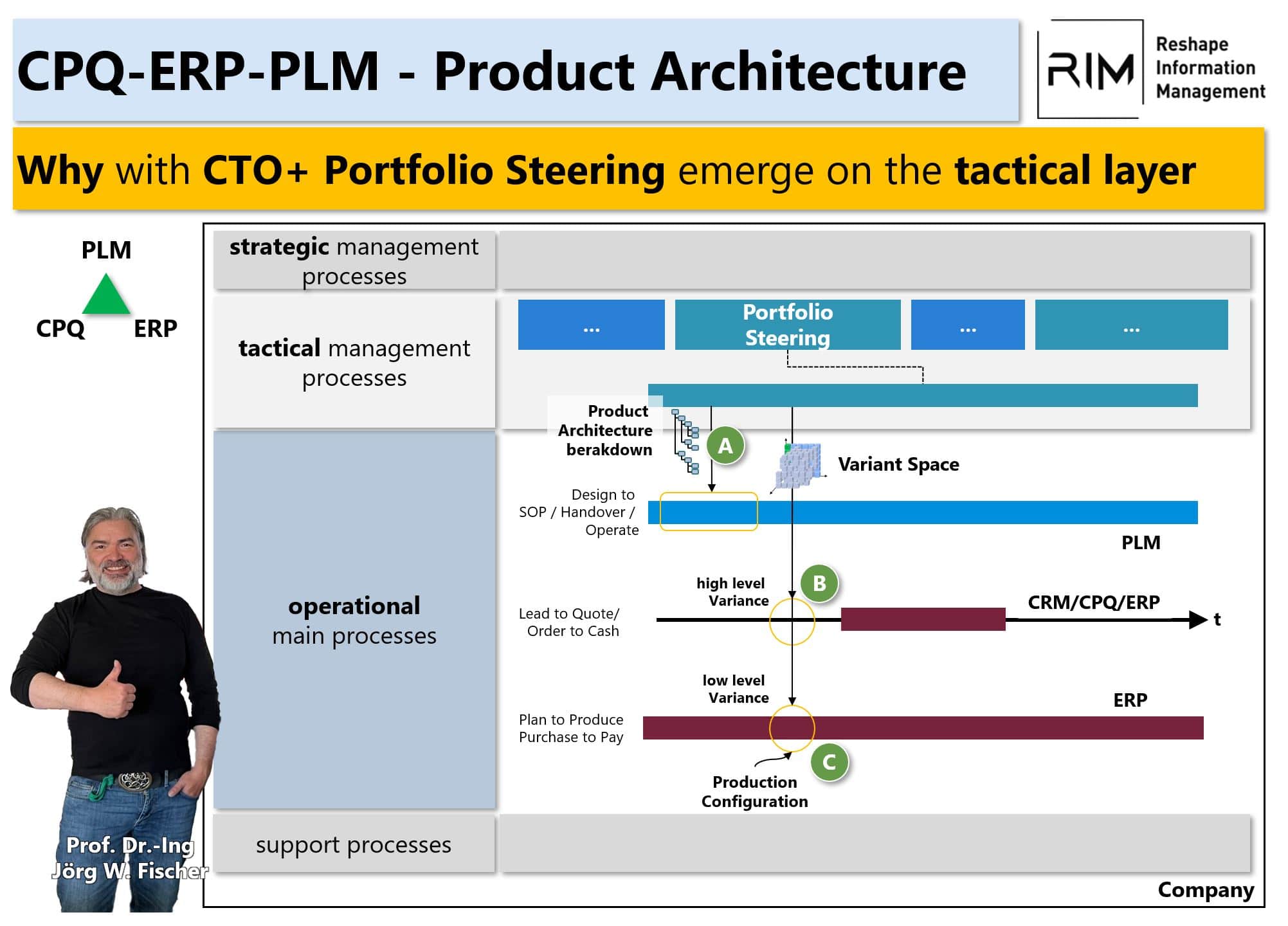

Why CTO+ creates portfolio steering at the tactical level.

CTO+, building blocks and modularization are key terms that guide the way companies think today. The buzzwords product architecture and portfolio steering go hand in hand with this.

How does all this work together and what does it have to do with CPQ-ERP-PLM?

In this post I would like to bring some systematics into this mixed situation.

Many companies are moving towards CTO+. In the process, new processes are emerging unnoticed that need to be anchored in the process architecture at a tactical level. Why? Because otherwise the toolkit, once developed, is often neither maintained nor used.

Well, I think the first thing to realize is that a product portfolio must not only be defined, but also continuously managed. From my perspective, this process is a management process that needs to be anchored in the process map at a tactical level.

What happens in the process? Once the framework for a portfolio has been defined by top management at the strategic level, it must now be filled with life.

Specifically, this is done by creating a product architecture or portfolio architecture for the portfolio elements.

These are essentially two types of structures, a classifying one that maps the product or portfolio hierarchy and one that maps the generic superstructure of a product. In addition, there is the development of a variant space from the perspective of the market (Figure Detail A). This process is decoupled from classic development and provides the product development process with the structures in which it can deliver its results.

From there, the lead-to-cash process and the plan-to-produce process are also supplied with the variant space. For lead to cash, this is the high-level variance and for plan to produce, the low-level variance. For the plan to produce process, there is also the production configuration, i.e. those options that only control production and do not contribute to the variability of the product.

Caution: I have described the case from STO/CTO to CTO+ here. The CTO+, which develops from the ETO, looks a little different.

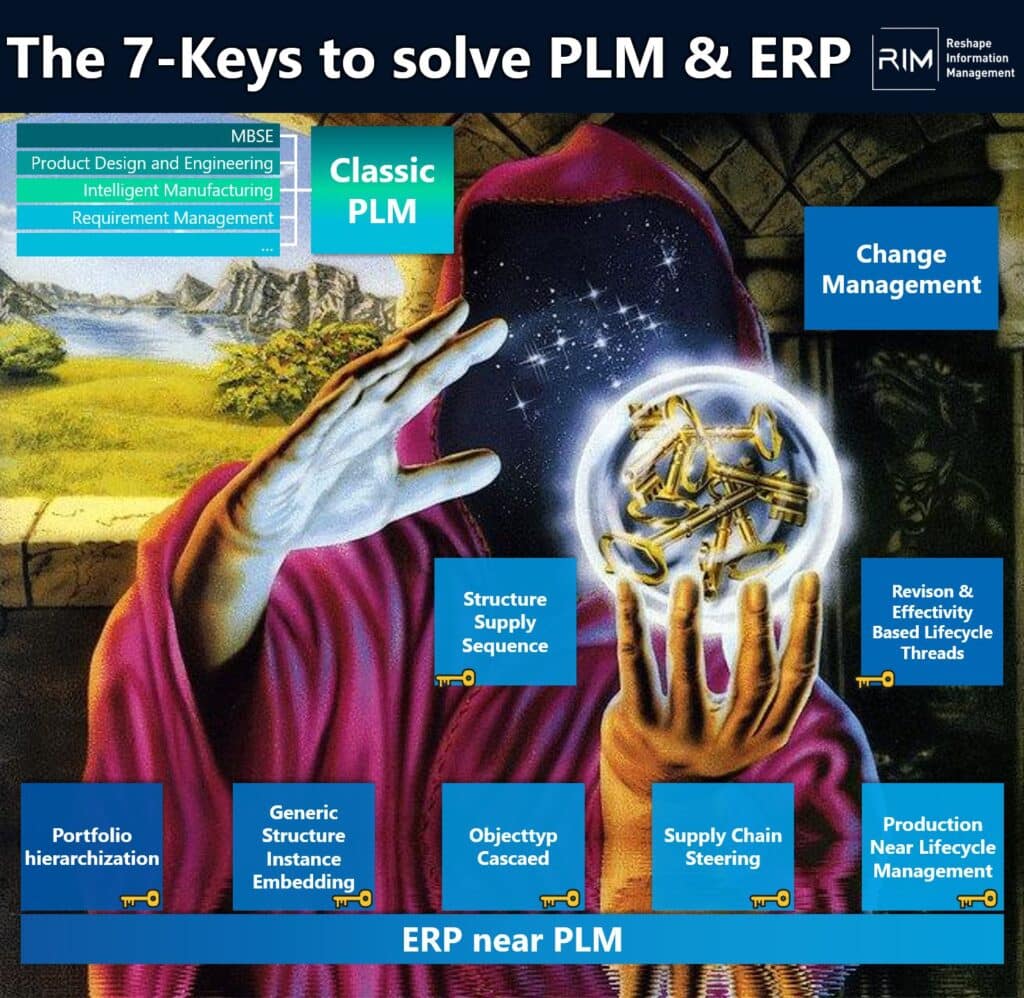

Well, so much for the theory. The pressing question for companies is what should be mapped in which type of IT system.

Well, roughly speaking, it's quite simple, but you have to look closely at the details.

Plan to Produce is supported by ERP.

Design to Operate from PLM and ERP-related PLM.

Lead to Cash from CRM, CPQ and ERP.

The vendor representatives of ERP, PLM and CPQ systems often take portfolio steering for themselves. This is in the nature of things. It is worth noting that new software systems are emerging on the market for the tactical level and portfolio steering. PALMA from Modular Management, PPG from SAP and METuS from PWC are good examples of this.

What do you think?

How do you anchor portfolio steering in your company?

LinkedIn post 2

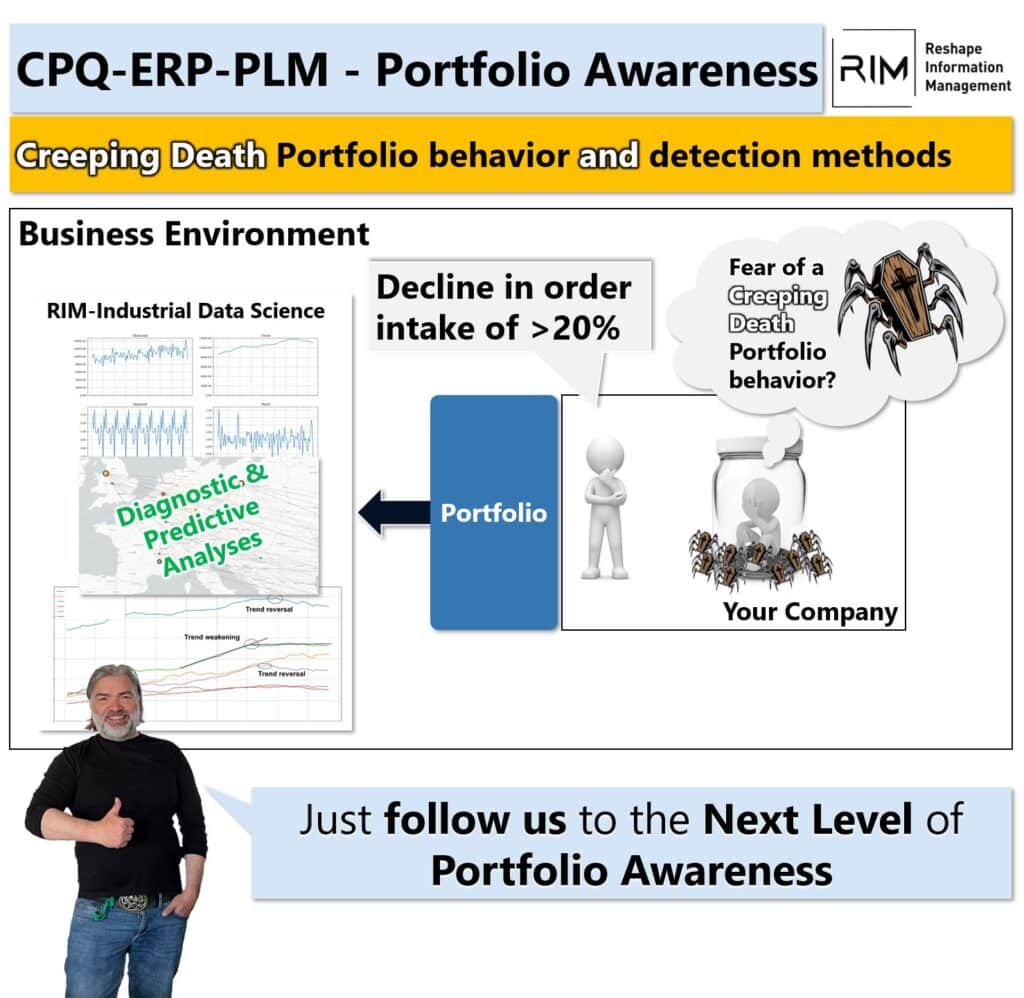

Portfolio Awareness - Might there be Creeping Death Behavior in your Portfolio?

Imagine the indicators are pointing to a downturn. Out of nowhere, you have a drop in incoming orders of 20%+. 📉

Will this develop into a tsunami for you?

If you have Creeping Death Behavior in your portfolio, maybe you do.

The success of many hidden champions is based on a modular system that is often 20-50 years old and has been continuously developed. The solution principles of this modular system and their skillful combination are the basis of the company's success.

You think you just have to adapt any new solution principles that come along?

The problem is more complex. In a time of multidimensional disruption, even slight changes in solution principles in skillful combination of the resulting packaged solution elements (i.e. products or systems) have enormous leverage on the market. Added to this is the convincing presentation of the resulting value proposition on the market.

I am convinced that even the slightest loss of attractiveness of the portfolio now has a much greater impact on the market than most people realize.

We refer to the effect of the creeping loss of attractiveness of parts of the portfolio as creeping death portfolio behavior.

What to do?

The effect is often hidden, is highly political within the company and is often argued away, as the effect is usually overshadowed by other market effects.

We at RIM are convinced that now more than ever we need to develop an understanding of portfolio awareness. An understanding of how the portfolio behaves in relation to the market.

There is generally a blind spot in companies here.

Why?

Classic descriptive analyses such as sales analysis by market/industry, region and the KPIs derived from these show this effect. This only shows that symptoms are present but not their real cause.

At RIM, we have developed our Industrial data science approach developed a series of Diagnostic & Predictive Analyses that can detect creeping death behavior of the portfolio.

We are convinced that such approaches will enable a completely new level of portfolio awareness for companies and that this will form the basis for genuine resilience in the portfolio.

If you are interested in finding out more, please get in touch with us. We look forward to supporting you! Contact STZ-RIM now - here are your options

What do you think? How do you anchor Diagnostic Analyses in your company? How do you manage to implement the corresponding portfolio awareness in your company? I look forward to your comments.